GM. This is the Daily Deposit. The newsletter that helps financial professionals get better, not worse, everyday.

The only Banking newsletter cooler than the other side of the pillow.

Let’s start by looking at what’s happening today, and then we’ll get better. I’m talkin bout that BBE, Big Banker Energy.

Today in Banking

Bank of America announced a record-breaking year for patents received in 2022 with 608 patents granted, a 19% increase year over year.

Financial services innovation has been white hot for several years now. Funding in Fintech is down this year from last, but banks are starting to wake up to the fact that they must innovate. Bank of America has clearly taken note with over 600 patents in these areas: artificial intelligence, machine learning, information security, data analytics, mobile banking, and payments.

Banks have traditionally been slow to innovate, but a reckoning is coming. Consumers want a Fintech user experience. Will consumers shift from their long-standing bank relationship to a high speed, low drag Fintech one? Maybe. But banks have a very sticky consumer base, and the faster they can innovate, the less likely they lose consumers.

Banking 101

Fractionalized Banking

The Federal Reserve Act of 1913 standardized the reserve requirements for banks and provided a means for the central bank to respond to financial crises by adjusting the money supply. Prior to this, the US had a system of state-chartered banks that operated under a variety of reserve requirements.

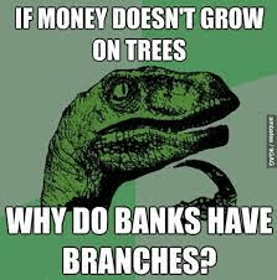

Who cares? Well, when the system got fractional, the required reserves at banks were reduced, allowing banks to issue loans and create money beyond the amount of coin in the vault. In other words, we started growing money on trees and could increase the money supply of the economy.

What could go wrong with printing money this way? It increases the likelihood of a bank run. If too many depositors simultaneously try to withdraw their money, the bank may not be able to pay up. Good luck trying to kneecap the bankers for your $$$. The whole system relies on the trust depositors have in the bank.

LULZ

1% Better

30-for-30 Challenge

This is a solid framework I came across through Sahil Bloom’s newsletter, The Curiosity Chronicle, that will help create a new habit or improve on an existing skill. The idea is that by consistently working on 30 minutes a day for 30 days, you can sprint a marathon. Everyone, except maybe Elon and Joe Rogan, has 30 minutes to spare. Use this strategy to make real progress.

reply with a Cold Stone bowl score… did you:

a) like it

b) love it

c) gotta have it