GM. This is the Daily Deposit. The newsletter that helps bankers get better, not worse, everyday

Protect yourself before you wreck yourself!

Today in Banking

Consumer trust remains high: 70% of Americans said they trust banks do what is right, according to Morning Consult

Banking 101

Fraudster Frenzy???

In light of the SVB bank run, collapse of Signature, and scares at First Republic and Credit Suisse, we've gotta ask: What else can go wrong? We know that bank collapses and bank runs can be devastating for depositors and investors, we've seen that mess over the last week. But this is no longer a localized event in Silicon Valley, this has reached the early stages of spreading into the broader financial system.

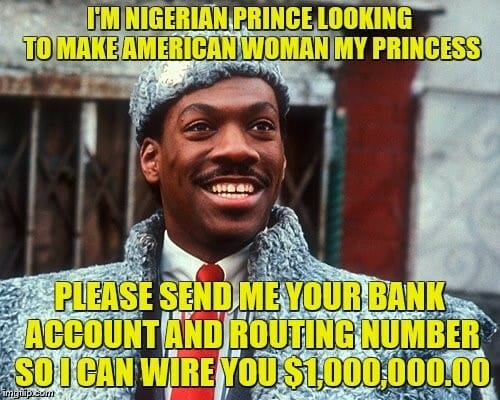

Now what is a good fraudster to do in times like these? I predict scammers are ramping up activity. The stakes are high as we know companies and investors are moving around big dollars. Big wires = big opportunity. How should banks protect against fraud and minimize further risk to these deposits? First of all, banks need to be extra vigilant, but they should also follow some basic measures:

1. Strong internal controls: Banks should already implement robust internal controls to ensure employees follow best practices and procedures to prevent fraud. These controls should include regular audits, risk assessments, and training programs to help identify fraudulent activities.

2. Risk management: Here's one SVB got wrong… Banks should have an active Chief Risk Officer, and should develop a comprehensive risk management framework. This framework should include regular stress tests to identify potential vulnerabilities and assess the bank's ability to withstand adverse events.

3. Customer due diligence: With the potential uptick in new customers, banks should conduct thorough due diligence on their customers (KYC), and identify those high-risk profiles to help prevent financial crime. Customers should also be doing their own KYB, or Know Your Bank. This is not easy if you're not a sophisticated financial institution already, but there is potential for a business here to provide this service. That is, assessing the health of a bank through balance sheet analyzation and liquidity risk profile.

4. Regulatory compliance: As always, banks should comply with all applicable regulatory requireents and guidelines to minimize the risk of non-compliance and potential sanctions.

5. Transparency: Communication is key, and banks should do what they can to maintain transparency with their customers and stakeholders. Clearly provide accurate info about financial position, risk exposures, and internal controls.

6. Cybersecurity: Lock this one down. Banks should ensure sufficient measures are in place to protect against cyber threats like phishing, malware, and ransomware attacks. Have vulnerability assessments, employee training, and incident response plans.

What type of scams should we be on the lookout for?

1. Phishing scams: Phishing emails or texts to customers of the bank, posing as the bank and asking for customer account information or personal details. I personally received one of these earlier this week from a bank I have no account with…

2. Identity theft: If a fraudster can get a hold of an identity, they can use that information to open fraudulent accounts and obtain credit in their names.

3. Ponzi schemes: If it's too good to be true, then it is… A fraudster may take advantage of the panic of these bank failures to promote a fraudulent investment scheme. In this case, watch out for promises of better protected deposits and out of the ordinary insurance coverage.

Let's be honest, anxious customers are concerned about the safety of their funds. Here's one scenario I could see playing out:

Phishing scam. During a bank run, customers may be anxious and desperate to protect their money, and a fraudster could take advantage of this situation by posing as a representative of the bank and offering to help customers transfer their funds to a "safe" account.

The fraudster could send out phishing emails or text messages to the customers, urging them to act quickly to protect their money. The messages might include a link to a fake website that looks like the bank's official site, where customers are prompted to enter their login credentials, account information, and other personal details.

Once the customer provides this information, the fraudster can access their account and transfer the funds to a different account that the fraudster controls. Alternatively, the fraudster might simply use the customer's account information to make unauthorized purchases or withdrawals.

Customers should never share their login credentials or personal information with anyone who claims to represent the bank unless they have verified their identity through official channels. Could be helpful for banks to remind customers of this risk. Additionally, customers should always use secure methods to access their bank accounts, such as by typing the bank's website directly into the browser's address bar instead of clicking on links in unsolicited messages.

Stay safe out there banksters.

LULZ

reply with a Cold Stone bowl score… did you:

a) like it

b) love it

c) gotta have it