GM. This is the Daily Deposit. The newsletter that helps bankers get better, not worse, everyday

The bagel bites of banking news! Piping hot no matter how long you wait.

Today in Banking

Crypto ‘Safety Net’? I’ll let you decide…

Stripe valuation drops: about half the valuation from 2 years ago

Banking 101

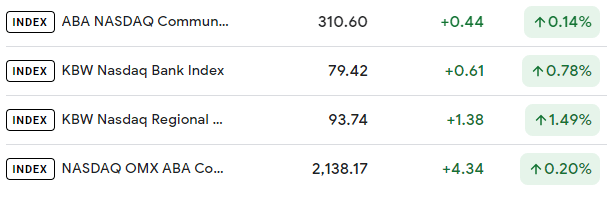

In recent weeks, there has been growing concern about the health of the banking sector, with some analysts warning of a potential crisis. Some of us are freaking out more than others…

While there are similarities to the 2008 financial crisis, there are also crucial differences that make it less likely for this episode to have the same seismic impact on the world economy.

The root cause of the crises is different, with the current crisis being caused by the Fed's rapid tightening rather than bad loans. The Federal Reserve's decision to scale back its bond purchases and raise interest rates in response to inflationary pressures has caused a spike in short-term borrowing costs, which has put pressure on banks' balance sheets. This tightening of credit conditions has led to a sell-off in risky assets and a tightening of lending standards, which has further dampened economic activity.

Traditional banks are involved this time around, and post-crisis reforms have improved capital ratios and given regulators more authority to resolve failed banks. One positive development is that the banking sector is generally in better shape than it was in 2008. Following the financial crisis, regulators implemented a range of measures aimed at improving the resilience of the banking system. These included stricter capital requirements, stress testing, and resolution plans. Banks now hold higher levels of capital, which has helped to absorb losses and reduce the risk of insolvency.

The 2008 crisis was largely driven by the collapse of subprime mortgages and the securitization of those mortgages. This time around, traditional banks are at the center of the storm, with many facing liquidity and funding pressures. However, unlike the 2008 crisis, the problems are largely contained within the banking sector and have not spread to the broader financial system.

Luckily, the risk of a vicious cycle feeding on itself like a human-centipede is also lower this time around. In 2008, the collapse of Lehman Brothers triggered a downward spiral that engulfed the entire financial system. Banks stopped lending to each other, credit markets froze, and the global economy plunged into recession. This time around, the problems are more contained, and there is less risk of a systemic collapse.

However, there are still potential obstacles that could derail the banking system. One of the most significant is the political environment. With the U.S. government facing a debt ceiling standoff and a potential government shutdown, there is a risk that political uncertainty could spill over into the financial markets. Another potential obstacle is the level of debt in the global economy. Debt levels have continued to rise since the financial crisis, and there are concerns that a significant increase in interest rates could trigger a wave of defaults. Eggs cost more than media subscriptions and the average car payment is up 13% from last year…

While there are important reasons to believe that recent banking troubles will be more manageable, the unpredictable nature of financial crises means that events could still move in non-linear and unexpected ways. It is impossible to predict with certainty how this crisis will play out, and there are still risks that could lead to a broader economic downturn. However, it is important to remember that the banking system is generally more resilient than it was in 2008, and regulators have more tools at their disposal to address any issues that arise. Thank you Dodd-Frank. 😍

If I had to guess, I'd say current events are not likely to have the same seismic impact on the world economy as the 2008 financial crisis. The root cause is different, traditional banks are involved this time around, and post-crisis reforms have improved the resilience of the banking system. There are still potential obstacles that could derail the banking system, such as the political environment and rising debt levels, so we'll be keeping an eye on that.

Stay tuned as this wild ride continues…

LULZ

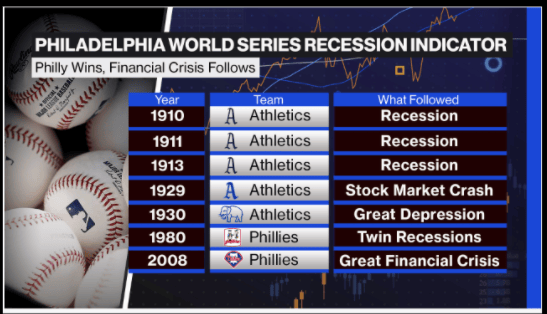

Astros beat the Phillies in 2022… We’re totally fine 😎

reply with a Cold Stone bowl score… did you:

a) like it

b) love it

c) gotta have it